County Clerk & Recorder

Welcome to the Effingham County, Illinois County Clerk’s office.

The Effingham County Clerk & Recorder’s office welcomes you. Our goal is to serve the citizens of Effingham County to the best our ability. It is the responsibility of the County Clerk to serve the public and uphold the law by following the Statutes of the State of Illinois. The County Clerk/Recorder’s office slogan which has been adopted many years ago is…. You are Always Welcome in the County Clerk’s Office.

Duties and Responsibilities

The County Clerk’s office provides a variety of services to the public including:

- Official keeper of the county seal

- Administrating elections in Effingham County

- Maintaining voter registration for Effingham County

- Calculates and extends tax rates on all real estate in Effingham County

- Collection of Delinquent taxes

- Maintain vital records in Effingham County (Birth, Marriage & Death)

- Issuing Marriage license

- Maintain Assumed Name Business Certificates

- Maintain Statement of Economic Interest

- Issuing Liquor license and Raffle license

- Processing Accounts Payable for Effingham County

- Processing Payroll for Effingham County

- Clerk or Secretary to the Effingham County Board – take/create board minutes

- Maintain County Resolutions and Ordinances

- File financial reports, budget and levy from local taxing entities

- Filing of Military Discharge DD214

- Recording and Maintaining permanent and public record of real estate transactions

The County Clerk is the keeper of all county records. As Clerk to the County Board the County Clerk attends the monthly meetings of the Board and records the minutes. The County Clerk is the keeper of the official seal of the County of Effingham. This seal is used to certify certain records of the county Board and the County Clerk’s office.

- It shall be unlawful for any person to conduct or operate a raffle, or sell, offer for sale, convey, issue, or otherwise transfer for value a chance on a raffle, unless conducted pursuant to a license duly issued by the County and in accordance with the provisions of this Article.

- Raffle licenses shall be issued only to bona fide charitable, educational, religious, and veteran’s organizations that operate without profit to their members and which have been in existence continuously for a period of five (5) years of more immediately before making application for a license.

- Raffle licenses may be issued for a medical benefit. An additional form is required.

- Paperwork must be completed and may be downloaded (see below). Paperwork must be notarized and returned to the County Clerk’s office for approval and then the raffle license may be issued.

- Cost is $10 and each license is good for one year.

- For complete guidelines, see Effingham County Raffle Ordinance.

Registering a Business

Assumed Business Name

- Individuals starting a business in the County using a name for the business other than their personal name are required by Illinois State Statute to register their business name. This requirement includes registration for sole proprietorships and general partnerships.

- Necessity of Certificate – ILCS 405/1

- NOTE: Corporations and Limited Partnerships file with the Secretary of State. The business owner should seek legal advice to determine what filings are necessary in such cases. Secretary of State – (217) 782-7880

- To apply for an assumed name certificate the business owner must fill out a form. This form can be obtained from our office in person or online through https://ileffingham.fidlar.com/ILEffinghamVS/Apex.WebPortal/.

- Information required for the form include the business name, business address and owner(s) name and owner(s) address. Owner must sign the form at the County Clerk’s office.

- There is a $20.00 filing fee. Payment of cash or check is accepted.

- The County Clerk’s office will provide a Publication notice that must be published for three consecutive weeks in the newspaper of your choice in Effingham County. The first publication must appear in the newspaper within 15 days after the dale you filed the form in our office. Publication cost will be your responsibility.

- The Certificate of Publication MUST be filed with our office within 50 days after the Assumed Name Certificate was filed in our office . It is the responsiblity of the business owner to file the Certificate of Publication with our office. Once the Proof of Publication is filed, our office will send you a Certificate of Ownership. Unless proof of publication is filed with our office, the application of the Assumed Business Name is VOID.

- A Supplementary Assumed Business Name form must be filed under the following circumstances:

- An owner changes his name or his residential address

- The address of the business changes

- Addition or Removal of a business owner

- The supplementary Assumed Business Name forms are available at the County Clerk’s office.

Statements of Economic Interest are disclosure forms for public officials, candidates for public office and certain other public employees. Filers must list specific information about their business dealings, outside income and other information. Those required to file must file with the County Clerk annually, no later than May 1.

On August 4, 1993 Public Act 88-187 was signed into law, as an amendment of the Illinois Governmental Ethics Act which significantly revises the requirement for filing Statements of Economic Interest.

Please click the link below to print your form.

DOWNLOAD ECONOMIC INTEREST FORM

Who must file a Statement of Economic Interest?

Individuals in a unit of local government who must file a statement of economic interest are below (Illinois Governmental Ethics Act, 5 ILCS 420):

- Persons who are elected to office in a unit of local government, and candidates for nomination or election to that office, including regional superintendents of school districts.

- Persons appointed to the governing board of a unit of local government, or of a special district, and persons appointed to a zoning board, or zoning board of appeals, or to a regional, county, or municipal plan commission, or to a board of review of any county, and persons appointed to a board or commission of a unit of local government who have authority to authorize the expenditure of public funds. This subsection does not apply to members of boards or commissions who function in an advisory capacity.

Persons who are employed by a unit of local government and are compensated for services as employees and not as independent contractors and who:

- are, or function as, the head of a department, division, bureau, authority or other administrative unit within the unit of local government, or who exercise similar authority within the unit of local government.

- Have direct supervisory authority over, or direct responsibility for the formulation, negotiation, issuance or execution of contracts entered into by the unit of local government in the amount of $1,000 or greater.

- Have authority to approve licenses and permits by the unit of local government; this item does not include employees who function in a ministerial capacity; adjudicate, arbitrate, or decide any judicial or administrative proceeding, or review the adjudication, arbitration or decision of any judicial or administrative proceeding within the authority of the unit of local government.

- Have authority to issue or promulgate rules and regulations within areas under the authority of the unit of local government.

- Have supervisory responsibility for 20 or more employees of the unit of local government.

- Are employed by a school district in positions that require that person to hold an administrative or a chief school business official endorsement.

The tax computation report contains a wealth of property tax information for each taxing district. This includes the equalized assessed valuation (EAV) of each type of property within the district, the amount levied for each purpose, the total tax rate and much more.

Click here for Effingham County Tax Computation Reports

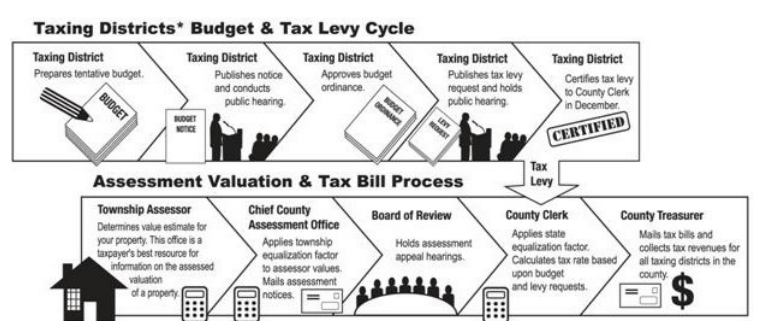

The property tax extension process is a complicated one that involves collaborative work between the local government bodies who levy taxes, Township Assessors, the County Supervisor of Assessments, the County Treasuer and the County Clerk. All parties involved must work together to make sure the property tax bills are sent out on time so that the local government who rely on those taxes to do things such as maintain roads, run schools, keep residents safe and healthly and provide services, get those tax dollars on time.

IACCR Property Tax Manual

Illinois Property Tax Rate and Levy Manual

Taxing Districts:

Filing of Budget and Appropriation Ordinance (35 ILCS 200/18-50)

The governing body of each taxing district shall file with the Effingham County Clerk within 30 days of their adoption a certified copy of its appropriation and budget ordinances or resolutions, as well as an estimate, certified by its chief fiscal officers, or revenues, by source, anticipated to be received by the tax district in teh following fiscal year.

If the governing body fails to file the required documents, the County Clerk shall have the authority, after giving timely noitce of the failure of the taxing district, to refuse to extend the tax levy until the documents are filed.

Filing of Levies of Taxing Districts (35 ILCS 200/18-15)

All taxing districts shall annually certify to the Effingham County Clerk on or before the last Tuesday in December, the several amounts that they have levied. Accompanying the levy must be a Certificate of Levy and Truth in Taxiation Certificate. All documents must have original signatures, notarized and sealed with districts’ seal Failure to do so could mean a loss of tax dollars

Levy for Bonds (30 ILCS 350/16)

A government until may levy a tax for the payment of principal or and interest on General Obligation bond at my time prior to March 1 of the calendar year in which the taxes will be collected. As certified to the Clerk by the taxing district, the levy sets forth the dollar

amounts to be raised by taxation.

REQUIRED FILINGS WITH THE COUNTY CLERK

1. Budget and Appropriation Ordinance

2. Certification of Budget & Appropriation Ordinance (original signatures and seal)

3. Certification of Estimated Revenues by Source (original signatures and seal)

4. Tax Levy

5. Certification of Tax Levy (original signatures and seal)

6. Certification of Truth in Taxation Compliance

7. Annual Financial Report of Taxing District (immediate past year)

- The Effingham County Clerk’s office issues liquor licenses for only unincorporated businesses in Effingham County. An application must be completed, filed and approved by the Effingham County Liquor Commissioner. Businesses seeking a liquor license for use inside a municipality should contact the local city or village clerk.

- Regulation of liquor licensing is dictated by the Illinois Liquor Control Act and the Effingham County Liquor Code.

- Effingham County Liquor License applications can be obtained in person at the Effingham County Clerk’s office.

- If you need a temporary liquor license for Effingham County, the following are the requirements:

- Cost is $100.00 per day. If the event goes past 12:00 a.m. that is considered another day with an additional $100.00

- Application must be completed.

- Required letter stating who, what, when, where (include address) and why.

- Temporary license is for events in unincorporated areas in Effingham County.

- If you are applying for a permanent liquor license for the first time, the following are the requirements:

- Cost is $1005.00

- Application must be completed.

- Required letter stating who, what, when, where (include address) and why.

- You will receive a copy of the ordinance

- You must renew the liquor license annually with a renewal date of May 1st.

Delinquent Tax Process

General

Each year many property owners pay their real estate taxes late or are unable to pay them altogether. The information below explains how the property tax collection process works in Effingham County.

Prior to the Tax Sale

The Effingham County Treasurer sends tax bills to property owners once a year with two installment due dates. Payments not received in the County Treasurer’s office or that are not postmarked by the due date are subject to a 1.5% penalty per month, which is in compliance with Illinois State Statute. Tax payments not received by the second installment due date will be considered DELINQUENT and are subject to publication and tax sale. The treasurer is required to send a final notice by Certified Mail to the owner of the record shown in the county tax system before the taxes are sold at tax sale.

Tax Sale

The tax sale in Effingham County is held annually (month may vary slightly). The “tax buyer” who bids the lowest rate of interest pays the County Treasurer’s office the total taxes that were due plus costs associated with the sale and fees. Any questions on Tax Sale procedures and delinquent property lists should be addressed to the Effingham County Treasurer at 217-342-6844

Period of Redemption

Following the tax sale, all records are turned over to the County Clerk for redemption.

Within 4½ months of the tax sale, the tax buyer is required to mail a notice of the sale (called a “Take Notice”) to the party in whose name the taxes were originally assessed (which may not be the current owner).

If your unpaid taxes have been sold, the Clerk’s office can provide you with an “Estimate of Redemption”, detailing the amount necessary to redeem (pay) your taxes and remove the threat of losing your property. You may simply call the County Clerk’s office to inquire about the amount owed and request an estimate.

The redemption of these taxes must be made in one FULL PAYMENT. State law prohibits accepting partial payments. Payment may only be made by certified funds – cash, cashier’s check, certified check or money order. Cashier’s/certified checks or money orders should be made payable to the Effingham County Clerk, and the parcel ID number should be written on the check. Payments may be made in person or by mail. Once the redemption is satisfied, a receipt will be issued.

Subsequent Taxes

In each following year, if the new taxes billed in that subsequent year are not paid, the current tax buyer has the option of buying these taxes after the second installment is deemed delinquent and before the next tax sale. If the tax buyer does so, the current year taxes are added to the redemption total with a 12% per year penalty attached. NOTE: If the tax buyer has petitioned the courts for a tax deed, the tax buyer does not need to wait until the second installment is delinquent. In that situation, the tax buyer has the option of buying the taxes as soon as the tax bill is issued.

Costs of Tax Deed Process

Within three to six months before the period of redemption expires, the tax buyer must initiate the legal proceedings to eventually obtain the tax deed. The tax buyer petitions the Circuit Court of the County. Any costs associated with those legal proceedings incurred by the tax buyer can be added to the redemption total at any time (but no later than 1 month before the last date to redeem). As part of the petitioning process, a final “take notice” will be sent to any interested party by Certified Mail. This final take notice advises the parties of the final date to redeem on said property and when a hearing will be held in the Circuit Court in order for the tax buyer to take ownership of the property.

After Redemption Period Expires

The tax buyer must appear before the Circuit Court of Effingham County. The owner may be present at this hearing, but the right to redeem will already have expired at that time. The Circuit Court reviews the evidence and must be satisfied that the tax buyer has fulfilled all statutory obligations and that the period of redemption has expired. If the court deems that the tax buyer has fulfilled all the legal obligations, the Court will order the County Clerk to issue a Tax Deed, transferring ownership of the property to the tax buyer.